Optimize

Our advanced simulation tools and algoriths enables advisors to optimize portfolios not just for returns but also for risk, ensuring a balanced approach that aligns with clients’ risk tolerance while aiming for optimal performance.

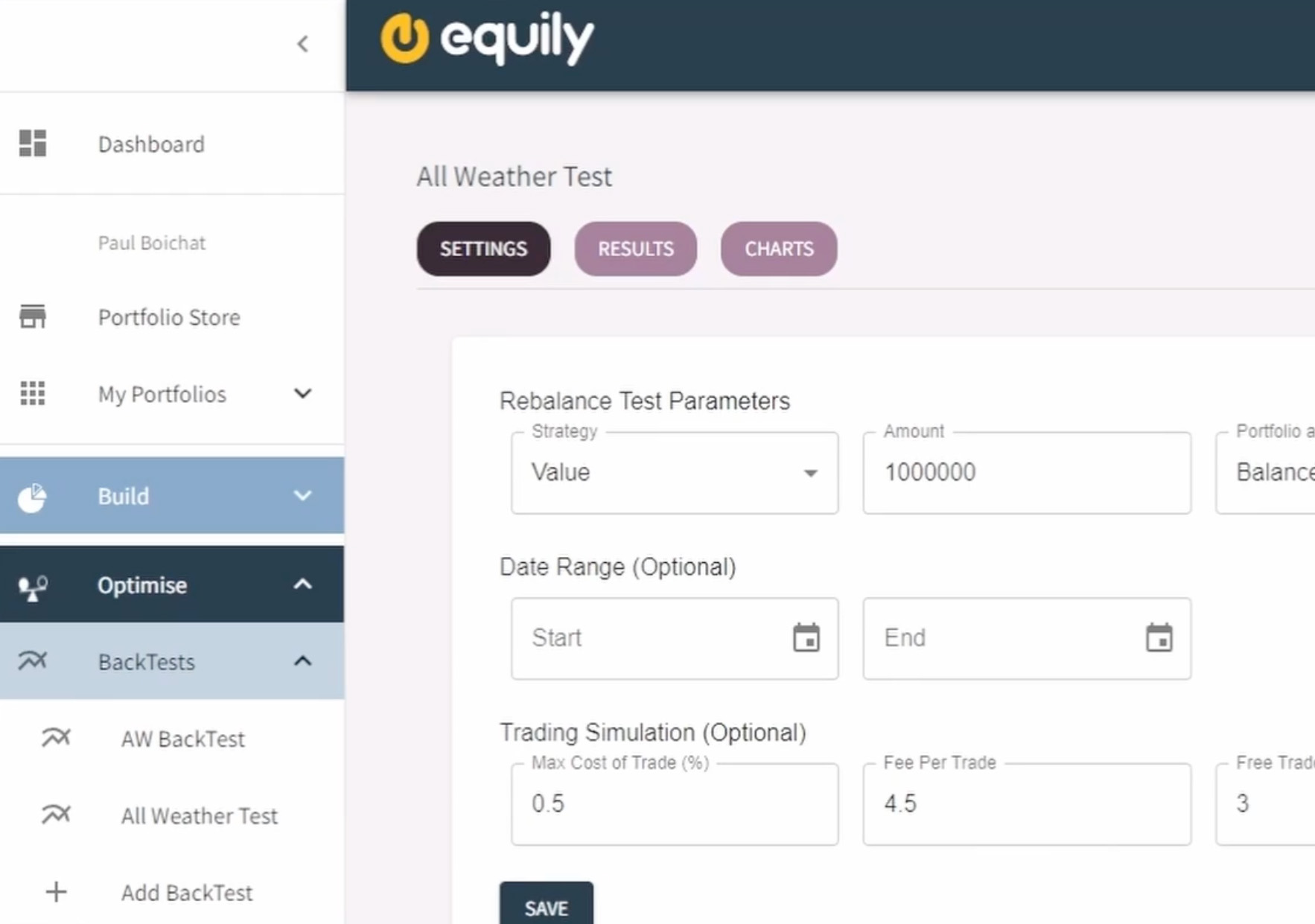

Backtest Suite

Our backtesting suite allows anyone to play with different investing strategies and rebalancing rules to determine the optimal return for their portfolio. equily can leverage data from a real-world portfolio or start with a simulated balanced portfolio to see the results.

Smart Algorithms

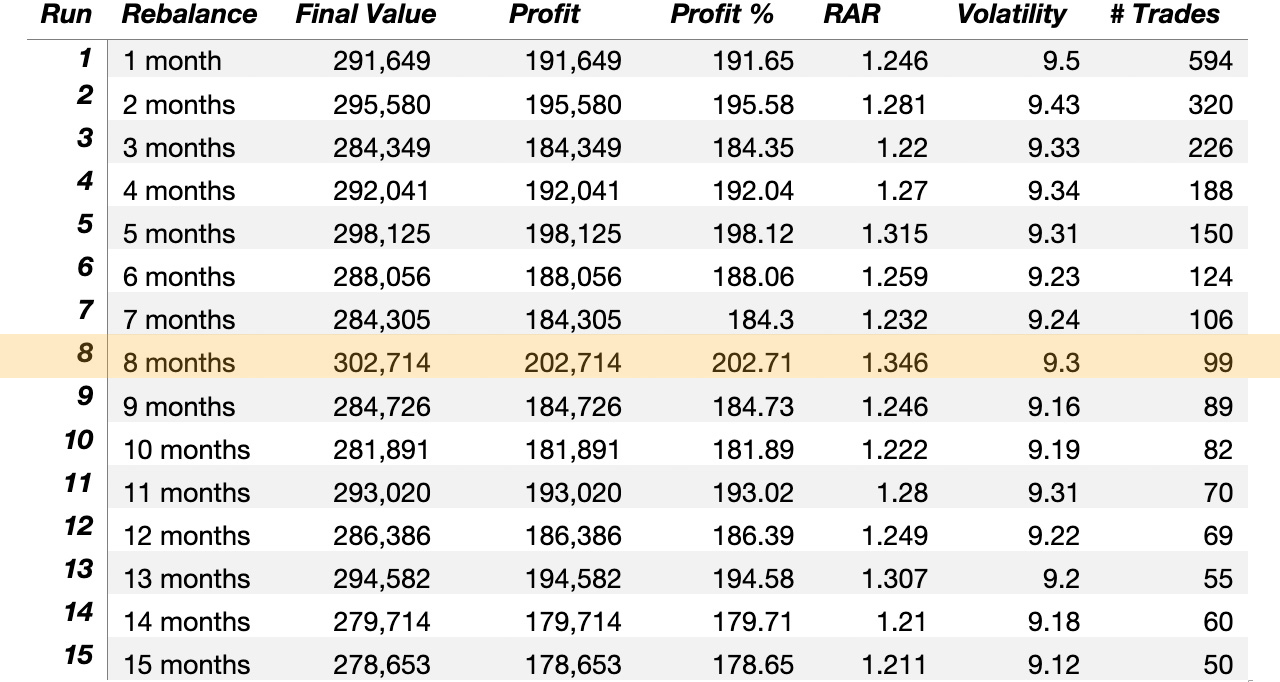

Find the rebalancing premium with smart algorithms that help track down the optimal balance between risk and returns.

Play & Learn

Run multiple backtests to see the impact on key financial metrics, including risk adjusted return, volatility and profitability. As well as any incurred trading costs.

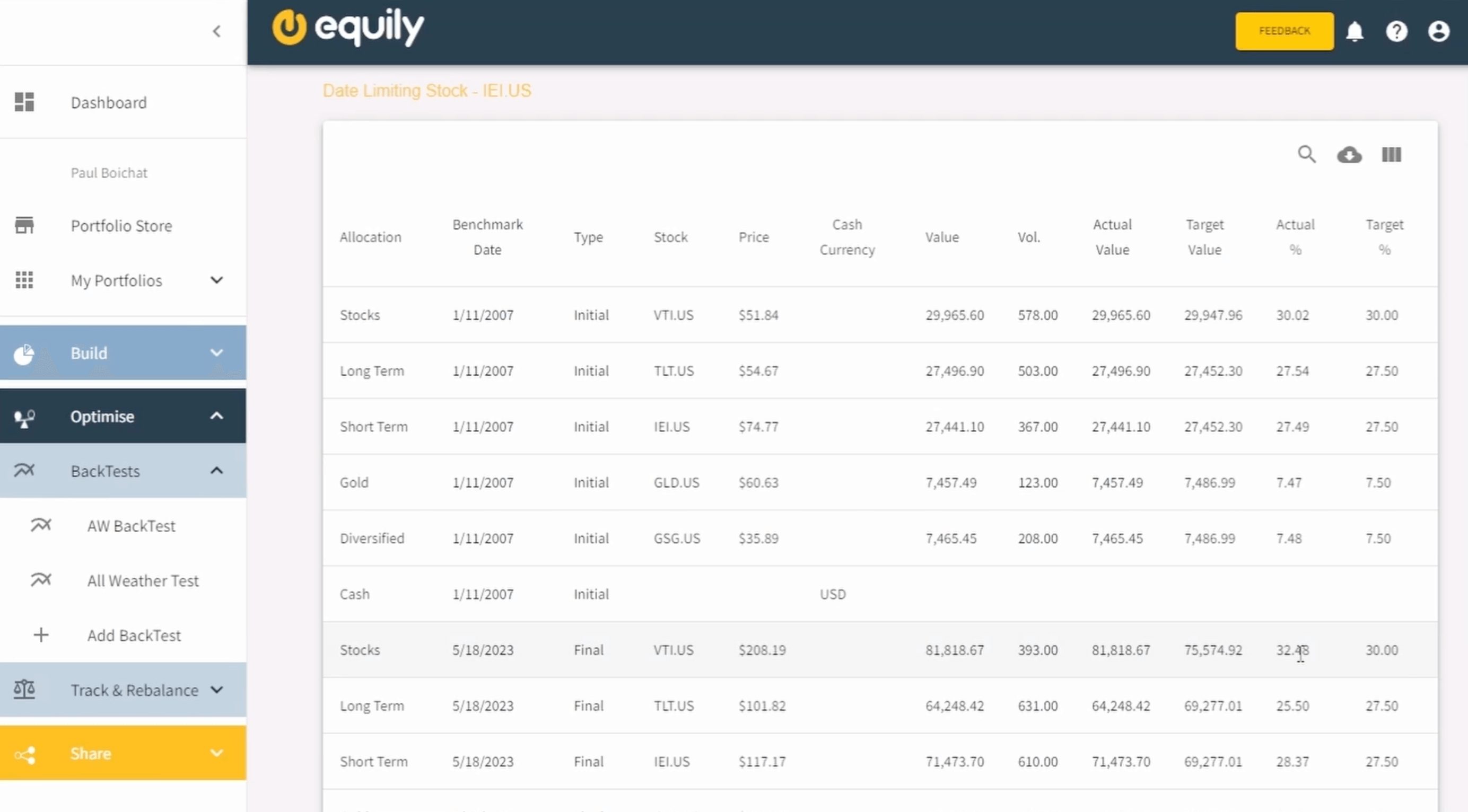

Trading Visualization

Delve deeper into each backtest to see the timing of trading the was performed by the rebalancing rules. See the difference in the investment allocation at the start and end of the run. Export the data for further analysis outside of equily.

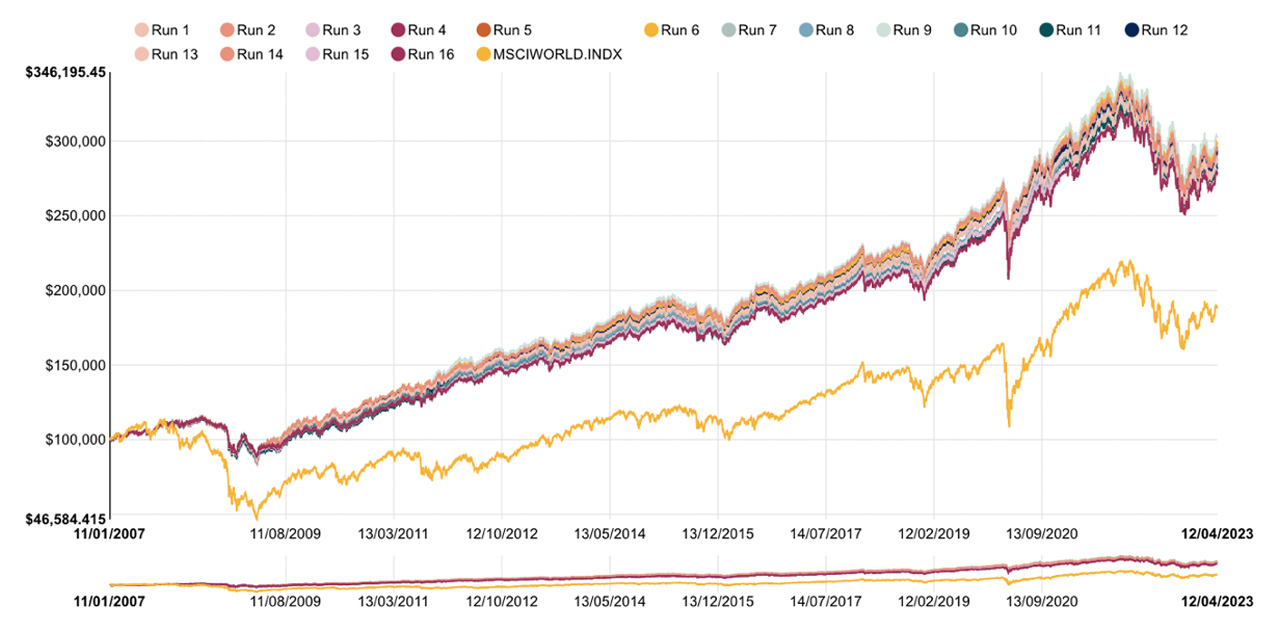

Finding the optimal return

By comparing backtest runs in detail and visually, you can easily determine the optimal strategy for your client’s portfolio and risk appetite.

equily support

Access insight and resources to help support your client investment strategies.